Although 2023 was a turbulent year for the beer industry as a whole, trends for six packs are beginning to emerge in 2024.

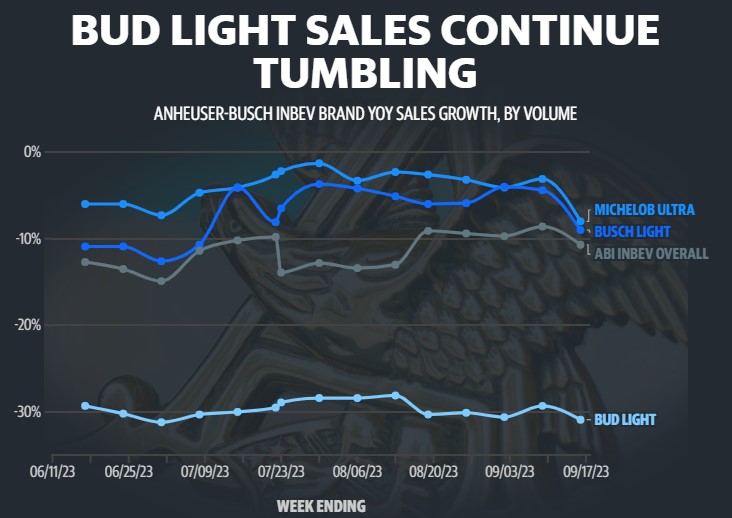

As the boycott against Anheuser-Busch InBev (BUD) continues to unfold, industry participants such as Constellation Brands (STZ) and Molson Coors (TAP) vie for greater market share, while the manufacturer of Bud Light attempts to recover.

Additionally, businesses will need to adapt to shifting consumer preferences, such as the growing popularity of Mexican import beers (light lagers), tinned cocktails, and non-alcoholic alternatives.

“The Bud Light controversy… was likely the most significant factor influencing the beer industry [in 2023],” Yahoo Finance vice president Filippo Falorni of Citi stated. He stated that domestic brands such as Miller Light and Coors Light captured 80 to 85 percent of Bud Light’s share losses.

Brand volumes in the United States increased 4.5% in the third quarter for Molson Coors, as Coors Light and Coors Banquet recorded double-digit growth, while Miller Lite experienced single-digit expansion.

The company disclosed unsatisfactory quarterly outcomes on Friday, citing a 4% increase in beer sales due to increased demand for its Modelo Especial and Pacifico lines. On a call with investors last year, the two Mexican imports ranked first and second, respectively, in terms of market share growth for draft beers, according to CEO Bill Newlands.

He stated that Constellation’s packaged Corona Extra is the most popular beer sold on-premises in the United States.

This year, the beverage colossus and others with Mexican import brands may make additional strides, according to Bump Williams of Bump Williams Consulting.

“Retailers have already begun allocating more shelf space to these brands in this segment in the second half of ’23,” Williams told Yahoo Finance via telephone. “That will likely continue to grow as the spring sets are introduced in March and April of 2024.”