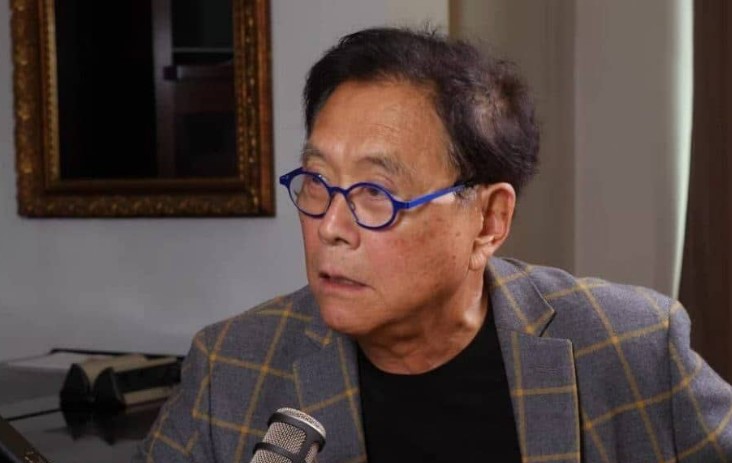

A recent episode of “The Rich Dad Radio Show” featured financial educator and author Robert Kiyosaki, who conveyed significant apprehensions regarding the fiscal well-being of the United States.

“The United States is currently bankrupt,” he declared. “And the question I want to answer today is how [come] America, at one time reportedly the richest country in the world, is now bankrupt?”

Although not officially declared bankruptcy, Kiyosaki’s argument highlights the escalating debt crisis faced by the United States.

The U.S. national debt had accumulated to $33.8 trillion as of November 24. Jim Clark, chief executive officer of the Republic Monetary Exchange and the guest speaker, emphasized that actual liabilities, entitlements included, could reach $200 trillion.

In fiscal 2023, interest payments on this debt reached $659 billion, representing a 39% growth compared to the preceding year and a quantity that is nearly two times greater than that of fiscal 2020.

Thus, how does the renowned author safeguard his fortune? His conviction regarding physical attributes is unwavering. Included below are two of his faves.

Gold and silver

Predicated on the notion that the United States’ financial woes originated with the abandonment of the gold standard in 1971, Kiyosaki advises gold and silver investments. He perceives precious metals as protective measures against devaluation of currencies and inflation. In comparison to their historical zeniths, the current low prices of gold and silver, coupled with the increasing industrial demand for silver, render them exceptionally alluring. In contrast to numerous alternative investments, physical gold and silver do not entail counterparty risks, which he also appreciates.

Real Estate

In addition to precious metals, Kiyosaki advocates for real estate investments. He recently claimed to be the proprietor of 15,000 houses, which he employs as an effective inflation hedge. According to historical data provided by the Federal Reserve Bank of St. Louis, there has been a notable increase in rental costs and the median sales price of homes by 892% since 1963, in contrast to the consumer price index’s growth of 896%. This suggests that the real estate sector not only tracks inflation but may also surpass it.