Last Friday morning, I was in a hotel room in Washington, D.C., for the start of bank earnings, also known as the official start of earnings season.

My typical earnings day setup consisted of three large iced coffees, a digital notebook, headphones, soft-touch Lululemon apparel, and a story template that was open and ready to go.

I intended to learn three things from the major banks: 1) charge-off trends (Yahoo Finance covers many retail names), 2) the condition of the deal market, and 3) commentary on Wall Street hiring trends.

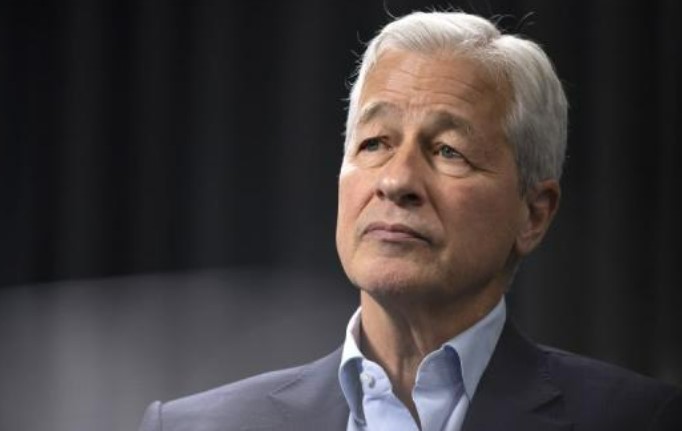

I subsequently accessed the JPMorgan earnings report. As usual, I combed through the numerals on the first page’s left rail. Then, as usual, I focused on the box in the bottom right corner of the page, which contained the most recent commentary from the company’s CEO, Jamie Dimon.

This remark by Dimon promptly came to mind: “This may be the most dangerous time the world has seen in decades.”

I remarked to myself, “Wow, that’s some serious intensity from Jamie.” “Never heard that tone from him before — what does it mean to the average investor?”

This earnings season’s outlook has been drastically altered by Dimon’s remark. I believe the approach to investing in the market has changed at the end of the year.

One word from the most influential CEO in the game today. And when he says something similar, investors must adopt a new way of thinking.

During the earnings call, Dimon elaborated on this theme, stating, “My caution is that we are facing so many uncertainties that you must be extremely cautious.” He added that he is concerned about the level of government debt and inflation, two issues on which he has focused in recent months.